Over the past decade, a string of sizable natural gas discoveries has been made in the eastern Mediterranean Sea that Egypt is working to reap its benefits, however, “Egypt knows well that it cannot become a regional natural gas hub until its own house is in order,” according to Stratfor.

Stratfor Research Center highlighted in its report entitled: “Egypt: The Eastern Mediterranean’s Next Natural Gas Hub?” the challenges that are facing Egypt because the case isn’t about “the number of discoveries, “but how to manage it?”

Egypt Past Experience: From A Net Exporter to A Net Importer

The research center recalled Egypt’s past experience the mid-2000s. By that time, Egypt became a net exporter of natural gas, because of the discovery of several deposits off its coast. “However, after peaking at 20 billion cubic meters (bcm) in 2009, Egyptian natural gas exports fell sharply as declining exploration, investment and upstream activity took their toll on the country’s output.”

By 2015, Egypt had largely closed its two natural gas liquefaction facilities and its pipeline to Israel, “once again becoming a net natural gas importer” said Stratfor.

According to Stratfor, the major problem behind this decline was that Egypt’s energy sector, as for the rest of its economy, was primarily the massive subsidies driving up domestic demand and dragging down production. Fixing the prices of natural gas at $2.65 per million British thermal units (mmbtu) since 2008 was a benefit for Egyptian consumers but a hindrance to outside investment.

Al-Sisi New Strategy Won’t Also Work

The report highlighted that despite Abdel Fattah al-Sisi’s harsh reforms against the domestic consumer, but “Egypt is unlikely to become the major natural gas exporter that it once was.” Abdel Fattah al-Sisi began implementing price reforms and paying energy firms more for their natural gas in 2014.

“Not only do industrial users now pay $7 per mmbtu, but Cairo has also begun to pay down its debts to international oil companies for the oil and natural gas they have already produced, “according to Stratfor. (Those debts totaled $6.3 billion at the end of 2013.)

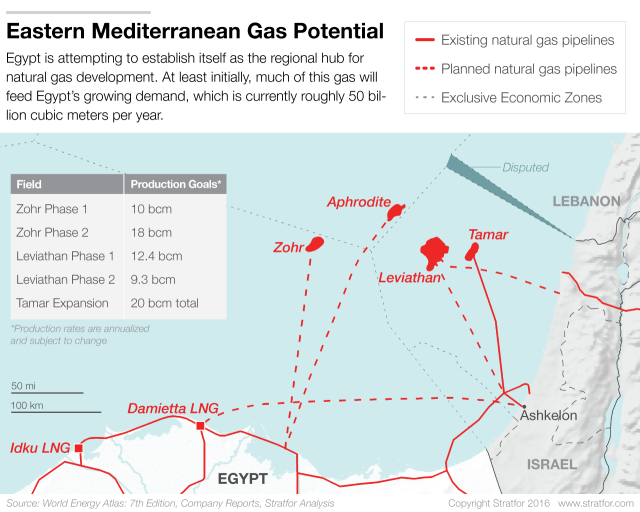

But there are many internal obstacles that act as barriers preventing Egypt from becoming a net exporter. The country’s annual consumption, which is currently at around 50 bcm, is expected to keep on rising — perhaps by as much as 20 bcm — in the coming decade.

At the same time, Egypt will have to continue raising energy prices, including hiking up electricity costs for households, so that it can afford to keep buying natural gas from producers. In August, the government did just that, increasing household electricity prices by as much as 40 %.

In the same context, Cairo has mandated that any new Egyptian output must first be put toward feeding the country’s own ever-expanding market which means that “little will be left to fill the 20 bcm of export capacity that the country’s liquefied natural gas facilities still have available, “according to Stratfor.

Consequently, most of the natural gas Egypt exports in the future will have to come from the stocks it buys from beyond its borders. Stratfor reported,” And for two of its neighbors, Cyprus and Israel, making use of Egypt’s existing LNG facilities is a far better option than sinking the capital required to build new ones.”

Egypt’s Natural Gas Partners

Prior to the revival in Egypt’s exploration activity, Israel and Cyprus were lucky in stumbling across the gigantic Aphrodite, Tamar and Leviathan offshore fields. However, Israel plans were thwarted by the newfound Egyptian deposits and by its own cumbersome bureaucratic process for approving the natural gas agreements. (Because Noble Energy and its partners are developing both of Israel’s major blocks, many were concerned that the deals would grant the companies an effective monopoly over the country’s natural gas market)

As a result, the Israeli Prime Minister Benjamin Netanyahu tried to force the natural gas accords through himself by leaning on his national security powers — a rare and controversial move. Netanyahu has faced stiff resistance from his Cabinet and the eventual resignation of his economy minister. In addition, Israel’s highest court blocked Netanyahu’s attempt, but Israel ultimately settled its issues with Noble Energy and, in 2016, approved the energy deals.

Nevertheless, “the repeated delays have pushed back Israel’s timetables, and the country’s Leviathan field will not come on line until after several of Egypt’s projects are operational,” said Stratfor.

With some of its regulatory hurdles behind it, though, Noble Energy is moving forward with its Israeli projects in the Leviathan and Tamar natural gas fields. In addition, Noble Energy has already signed contracts with several Israeli consumers. “But the primary focus of the company’s investments in the coming years will be Egypt and Jordan.”

In fact, the firm already has a nonbinding agreement in place with BG Group and Royal Dutch/Shell to send 7 bcm of natural gas every year, for 15 years, to the LNG facility in Idku, Egypt. It has a similar contract with the Egyptian Dolphinus Holdings to export 4 bcm per year for 10-15 years.

However, transferring Israeli natural gas to Egypt still presents a problem. There is a pipeline that has already been built between the two countries could serve as one solution, but negotiations over its use have hit a snag.

In 2015, Dolphinus Holdings promised to reverse the pipeline so that natural gas could be moved from Israel to Egypt.” But according to the pipeline’s operator, the company never contacted it to discuss the reversal,” said Stratfor.

In the meantime, talks over a 400-kilometer (249-mile) pipeline that would send Tamar’s natural gas to Damietta, Egypt, are still ongoing.

Cyprus’ projects, compared with Israel’s natural gas fields, are moving slower, thanks in large part to its small domestic market. Moreover, transporting natural gas from Cyprus’ Aphrodite field (also operated by Noble Energy) to its final destination may prove similarly challenging. The country’s recent pipeline deal with Egypt, as well as Shell and BG Group’s January acquisition of a 35%stake in the Aphrodite field, may inject new life into the Cypriot natural gas sector — particularly since the energy consortium undoubtedly considers Aphrodite a possible source of gas for its Idku LNG project. Even so, the pipeline’s planned start date between 2020 and 2022 shows that it has clearly taken a back seat to Noble Energy’s plans in Egypt and Israel.

Egypt New Discoveries and Natural Gas Agreements

In fact, Egypt’s massive Zohr field remains the Egyptian energy sector’s crown jewel. Cairo signed a deal with Italian firm Eni, pledging to pay $4.00-$5.88 per mmbtu of natural gas — a price in line with the going rates on the global market. Eni has agreed to fast track the development of the Zohr field. It alone is expected to yield 10 bcm a year when it comes on line in 2017, and 28 bcm a year when its second phase is completed in 2019.

Eni is not the only firm ramping up its activities in Egypt, either. BP has accelerated two of its own projects, the $12 billion West Nile Delta project and the Atoll project. They are expected to add 12.4 bcm and 3.1 bcm, respectively, to Egypt’s total output as they come on line over the next three years.

Recently, Cairo signed a preliminary deal with Cyprus on August 31 to build an underwater pipeline linking Cyprus’ Aphrodite gas field with the Egyptian coastline. If the project overcomes the considerable hurdles that still lie in its path, including uncertain funding, the pipeline could be operational by 2020, enabling Cyprus to finally begin producing from its largest known natural gas deposit.

In the end,Egypt’s history in natural gas discoveries tough seems promising ,but it couldn’t shift Egypt to a better place. In fact, the past domestic constraints won’t be worse than the current constraints facing Egypt under al-Sisi reign.

The major discoveries won’t be successful without reforming Egypt’s infrastructure and massive consumer market. Another important factor is the security and stability in the country, as gas pipelines have been one of the main targets bombed by insurgency groups in Egypt. Egypt faces a strong wave of violence against the Egyptian Armed forces and police in Sinai Peninsula and some provinces since the military coup in 2013 led by Abdel Fattah al-Sisi.

The lack of security has led to the downfall of the tourism sector and foreign investments which are the two main resources of hard currency in the country. As a result,Egypt has to resolve its internal conflicts and overcome its obstacles to take advantage of this huge gas hub.