BY: Abdel-Hafez Al-Sawi*

BY: Abdel-Hafez Al-Sawi*

The past days have remarkably witnessed an accelerating decline in the value of the Egyptian pound, to the extent that the decline in the pound’s value against the dollar occurred more than once during one day.abdel Accordingly, the US dollar has surpassed the 13-pound barrier, reaching over 16 pounds.

The concern in the exchange rate issue is no longer restricted to investors for the considerations of feasibility studies and investment decisions, or to the importers for fulfilling their foreign obligations. However, the small savers have also been affected by the decline in the pound’s value against the dollar, which in turn pushed them towards dollarization to protect their small savings – particularly those who have fixed and limited incomes, cannot cope with the large fluctuations in the prices in goods and services, and rely on the little margin they earn from their savings to help them face the high cost of living.

The exchange rate crisis also pushed many to practice dollar speculation, and led to widening the black market scale. This made the process of measuring the real dollar exchange rate a difficult matter and the demand on dollar and other foreign currency in Egypt as not real.

Of course, the economic conditions always change; and according to practices, we always monitor the so-called economic cycles. Societies usually go through cycles of:

- Rrecession and depression,

- Then they undergo a process of recovery,

- And finally they reach a stage of boom and complete recovery.

But each of these three phases depends on the economic policies adopted, and the management of economy. With effective economic policies, the first and second phases can be bypassed in a short time, while the stage of boom and recovery takes the longest possible period of time, as it represents a state of success.

Our talk about the future of the exchange rate in Egypt requires a discussion of:

- Egypt’s resources of hard currency,

- How the government dealt with the issue of the exchange rate,

- The future of the exchange rate in Egypt.

-

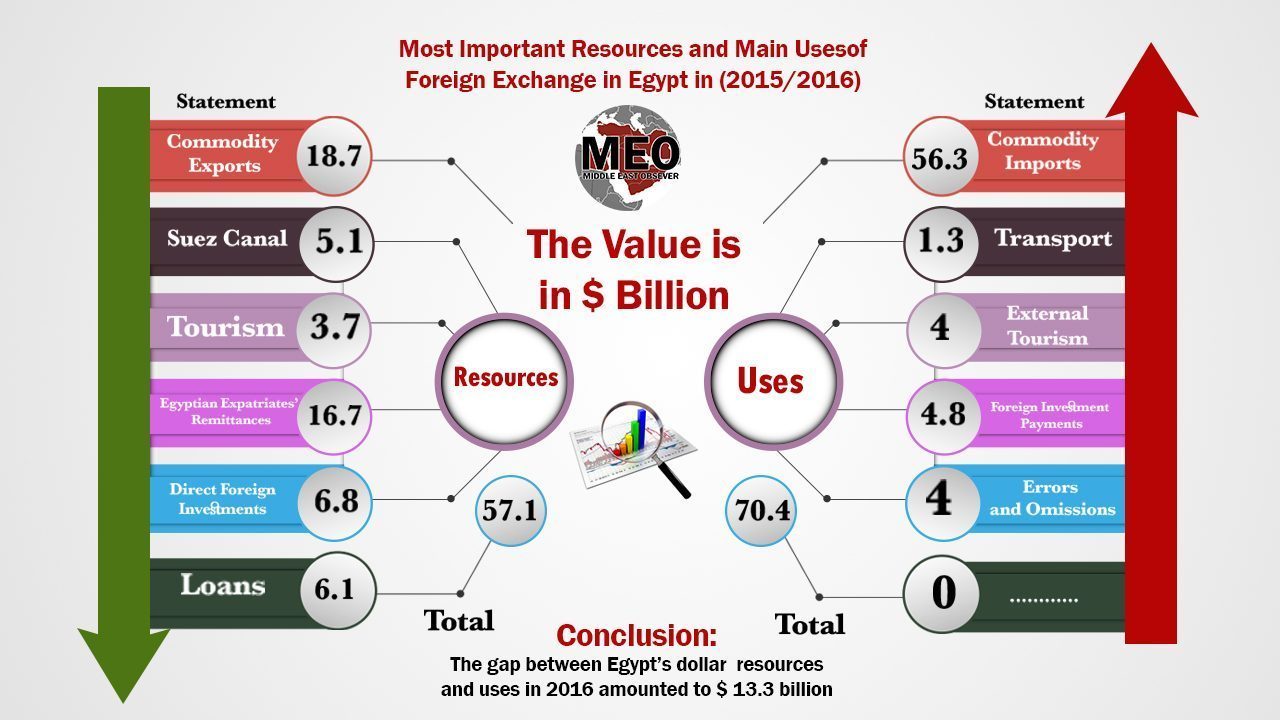

First, Egypt’s dollar resources and uses:

Egypt’s major dollar resources can be monitored through the sources listed in the balance of payments prepared by the Central Bank of Egypt. According to the CBE balance of payments data for the fiscal year (2015/2016), we find that the dollar resources are represented in:

- The commodity export earnings, which amount to $ 18.7 billion compared to 22.2 billion in the previous year, a decline of about $ 3.5 billion.

- The Suez Canal revenues, which achieved $ 5.1 billion against $ 5.3 billion in the previous year, a decline of about $ 240 million.

- The tourism revenues, which amounted to $ 3.7 billion compared to $ 7.3 billion in the previous year, a decline of about 3.6 billion dollars.

- The remittances of the Egyptian expatriates, which amounted to $ 16.7 billion against $ 19.2 billion in the previous year, a drop of $ 2.5 billion.

- The direct foreign investment, which achieved $ 6.8 billion compared to $ 6.3 billion, an increase of half a billion dollars.

There is a negative source of dollar resources in Egypt – according to what is stated in the CBE balance of payments data for the fiscal year (2015/2016) – which is borrowing from abroad, that reached $ 6.1 billion compared to $ 5 billion in the previous year, which means that Egypt has got more loans than last year by about 1.1 billion dollars.

Thus, Egypt’s major dollar resources – in addition to a secondary resource, which is borrowing from abroad – reached 57.1 billion dollars. This requires explaining Egypt’s dollar uses during the same year to show the gap and its impact on the exchange rate.

The data of the CBE balance of payments for the same year show that Egypt has used its dollar resources in:

- The payments of commodity imports that amounted to 56.3 billion dollars against 60.1 billion dollars in the previous year, a drop of $ 3.8 billion.

- The payments of transportation which amounted to 1.3 billion compared to $ 1.5 billion in the previous year, a drop of about $ 200 million.

- The external spending on tourism amounted to $ 4 billion compared to 3.3 billion in the previous year.

- Egypt’s payments to foreign investors amounted to about $ 4.8 billion against $ 5.9 billion in the previous year.

- The errors and omissions in the balance of payments was estimated at about $ 4 billion compared to $ 2 billion in the previous year.

A review of the expenditure items shows that Egypt’s dollar uses amounted to 70.4 billion dollars, which means that the gap between resources and uses in 2016 amounted to $ 13.3 billion.

This exposed the Egyptian economy to a real crisis in the exchange rate, where the annual dollar resources did not meet the government’s commitments in the same year. Moreover, the Egyptian government could not act within the framework of the foreign exchange reserves to fill this gap for a group of reasons, including that the gap between the resources and uses takes a large part of Egypt’s dollar reserves, estimated at about $ 15.5 billion at the end of July 2016. Also, almost all Egypt’s foreign currency reserves are only deposits and loans from foreign countries.

Most Important Resources and Main Uses

of the Foreign Exchange in Egypt in (2015/2016)

The Value is in $ Billion:

|

Resources |

Uses |

||

| Statement |

Value |

Statement |

Value |

| Commodity Exports |

18.7 |

Commodity Imports |

56.3 |

| Suez Canal |

5.1 |

Transport |

1.3 |

| Tourism |

3.7 |

External Tourism |

4 |

| Egyptian Expatriates’ Remittances |

16.7 |

Foreign Investment Payments |

4.8 |

| Direct Foreign Investments |

6.8 |

Errors and Omissions |

4 |

| Loans |

6.1 |

— |

— |

| Total |

57.1 |

Total |

70.4 |

Source: CBE’s balance of payments data for the fiscal year (2015/2016)

-

Second, how the government dealt with the exchange rate crisis:

Since the January 25 revolution, the Central Bank of Egypt (CBE) dealt with the exchange rate crisis, contrary to what should be done in such circumstances. At this time, the CBE adopted a policy of exchange rate protection at the expense of the foreign exchange reserves, enabling foreign investors to escape any losses regarding the government debt securities and the stock market in general. Also, this enabled the Mubarak-era officials and others to transfer their funds in the same way, regardless of the way of transference whether it was legal or illegal. Anyway, the exit of these funds helped to reduce the reserves of foreign currency in Egypt.

At the same time, the imports witnessed a remarkable upsurge without any action from the successive governments to rationalize imports, which led to more wasting of the limited and declining resources of the foreign exchange in Egypt.

Also, the way that the currency management worked out toward the devaluation of the Egyptian pound was characterized by hesitation, and came significantly late, causing the exacerbation of the black market. In addition, the CBE’s inability to meet the needs of foreign investors, whether they were for the direct or the indirect investment, created a state of mistrust among those investors, which forced out several major foreign companies, or at least they were prompted to reduce their activity in Egypt, or even assign their branches in other countries to undertake their business in Egypt.

The set of decisions on dollar withdrawal and depositing did not address the problem professionally, which contributed to giving a negative message to the dollar holders, and led to keeping savings and transactions outside the banking system.

The repeated media comments of the CBE governors also contributed to the escalation of the exchange rate crisis in Egypt, as they made promises that they were not able to meet. Examples for such comments were:

- Warning dollar holders to quickly get rid of their savings or they will face heavy losses.

- Announcing that the dollar price will decline to 4 pounds.

The economic management mishandled the employment of the available foreign currency – whether from the declining resources or from loans and deposits – through spending on armaments, and on infrastructure projects that only give long-term yields, while the government had short-term or, at best, medium-term commitments, which put the CBE in a state of permanent inability.

The Egyptian government was required to focus on financing the productive projects, removing the barriers to the main resources of foreign exchange – such as exports and tourism – and encouraging investments in the industry and agriculture sectors, and above all, providing a state of political and security stability – which the military coup failed to achieve after July 3, 2013, and was the major cause of the worsening economic situation in general.

-

Third: the future of the exchange rate in Egypt:

The problem of the exchange rate in Egypt is in the method that is carried out in treating the issue, where most of the decisions and procedures taken in this regard focused on short-term solutions, without considering the roots of the problem. In fact, the root of the problem is in the decline and weakness of the Gross Domestic Product, which drastically increases Egypt’s needs and dependence on the outside.

The simplest funding rules indicate the presence of inconsistency between resources and uses. However, the Egyptian economic management does not respect this rule; so it unleashed the process of external borrowing, bringing the external debt to about 55.3 billion dollars by the end of June 2016. According to stable economic criteria, the foreign “dollar reserves” – deposited in the CBE – are, no doubt, considered external debts that must be added to the external public debt. Accordingly, the foreign debt will exceed $ 75 billion.

The government of Sherif Ismail is now arranging to sell Banque du Caire to a foreign investor to use its price for supporting Egypt’s dollar resources. Unfortunately, the government repeats the experience of Atef Ebeid government at the beginning of the third millennium, when it sold the Bank of Alexandria to Italian investors. The result is that Egypt no longer thinks of increasing the dollar resources through exports and direct foreign investment. On the contrary, they sell assets, or resort to engaging in regional political projects that allow them to get grants and aid, as what happened in the Gulf War II and III.

Some are betting on Egypt’s access to the IMF loan, and the credit facilities associated with it, to rescue Egypt from its economic ordeal and its dollar crisis. The fact is that the economic reform program submitted to the IMF mission by the Egyptian government is the same reform program, which was presented in early nineties of the twentieth century. That program only focused on the financial and monetary reform, while the structural reform did not receive the required attention. This means that the loan package that Egypt will receive – estimated at $ 21 billion over three years – will not meet Egypt’s needs. Such loans will serve as relievers, but they will not put an end to Egypt’s economic crisis, or improve its dollar resources.

There is a very important development that has recently emerged, namely, that Egypt’s relations with the Gulf countries – particularly Saudi Arabia – which has been a major supporter of the military coup in Egypt – have witnessed remarkable tension. This may lead to the loss or at least a decline in Gulf aid, and will consequently deepen Egypt’s economic crisis.

Regarding the media talk that Egypt will be heading for Iran to compensate for the aid it used to get from the Gulf states, however, the same weaknesses will remain; as all these countries are keen that the assistance given to Egypt should act only as relievers, while the economic crisis should continue.

And therefore, we expect – in light of the current management of the exchange rate crisis in Egypt, and the weak potentials of the Egyptian economy – that this crisis will remain pressurizing most of Egypt’s macro-economic indicators.

*Abdel-Hafez Al-Sawi is an Egyptian economist. He has many economic writings, including: The Post-Revolution Balance, the Employment of Zakat Funds in the Muslim World, A Development Vision, and the Egyptian Economy between the Taxes and the Zakat.

(Written exclusively for MEO on Tuesday, Oct. 18, 2016, and translated from Arabic)