BY: Abdel-Hafez Al-Sawi*

BY: Abdel-Hafez Al-Sawi*

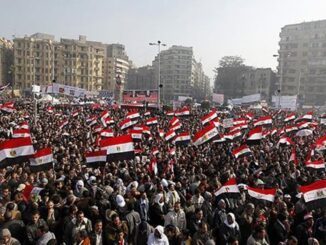

The Middle East has been “devoured” at the political level over the past few decades, which accordingly had its economic repercussions on the region. And after foiling the Arab Spring revolutions, the region is undergoing more negative repercussions. Though the period before the Arab Spring had allowed the existence of financial savings for the oil-producing regional countries, yet the post-‘Arab Spring’ period subjected everyone to living within the framework of the economies of the crisis.

With the beginning of 2017, the political factors are still an independent variable in drawing the map of the economic powers in the Middle East region. The internal wars experienced by some Arab countries (Libya, Syria, Yemen, and Iraq) have caused a decline in their economic performance, and if these wars did not end, they would create an economic dilemma with repercussions that could last for decades to come.

Also, the Iranian-Gulf conflict demonstrates a continued state of depletion of both parties’ oil resources, which has led to subjecting the Gulf countries to economic austerity programs and dedicated the Iranian economy’s dependence on the West in the coming period.

The Arab Maghreb region was not away from the negative economic fallout in the region.

Due to the crisis of the collapse of oil prices, Algeria has lost a large part of its foreign exchange reserves. Algeria’s foreign exchange reserves amounted to $ 139 billion in mid-2016 and are expected to reach $ 116 billion by the end of 2016 after it had been more than 200 billion dollars at the end of 2014.

Tunisia is living an economic crisis represented in expanding its external debt and seeking international grants and aid.

Morocco also suffers from a lack of recovery in the economies of the European Union countries, as well as the decline in rains which affected its agricultural harvest negatively. Also, the economic reform programs in Mauritania have failed so far.

As for Egypt and Sudan, the two countries are living a worsening economic reality, which appears clearly in the decline in the value of the national currencies of the two countries, the increasing dependence on loans and foreign aid, as well as the absence of political stability and security in Egypt, and the continuation of the economic sanctions imposed by the US on Sudan.

The year 2016 represented a major challenge for Turkey, which experienced a failed military coup, and has been suffering a decline in its national currency by nearly 30%, as well as a decline in direct foreign investment and tourism by the same proportion. Also, there are constant fears of the negative impact of the bombings targeting Turkey by the violence groups, especially in Istanbul, which sends negative messages abroad about the future of the Turkish economy.

While this negative atmosphere is pervading in all the countries of the region, we find that Israel has been careful not to engage in any conflict, and in particular with the Islamic Resistance Movement (Hamas), to maintain its economic capabilities, as it realizes that all the conflicts experienced by the region are eventually in its favor to wear down the economies of these countries. Accordingly, Israel will easily have a role in shaping the map of the region economically and politically.

***

As we have introduced a snapshot of a severely negative economic reality of regional countries, what are the expected scenarios for the region’s economies in 2017?

* The reconstruction scenario

In the case of adopting an optimistic scenario about the political situation in the countries of the region, it is expected that there will be compromises to end the armed conflict, as well as a state of consensus between Iran and the Gulf countries. Also according to this scenario, a solution will be reached in Egypt so that the country could get out of its political crisis, and Turkey will succeed in solving its political files internally and externally.

Though the activation of this scenario on the ground can start this year, however, it is unlikely to be completed during 2017, and it may require at least another year. So, this scenario is not expected to succeed. Yet what if the opposite was correct and the optimistic scenario found a ground for acceptance and activation?!

On the economic front, there will be a high cost in the short term, namely in the reconstruction of Syria, Yemen, Iraq, and Libya. Such programs usually take from 3 to 5 years, but unfortunately, their cost will be in the form of debts and a few international aids and grants. This will put the future generations under the pressure of bearing this cost in the medium and long term.

Egypt, Tunisia, Sudan, and Mauritania need investment packages of not less than $ 100 billion annually over the next five years, with a total cost of about $ 500 billion, so that they could work to raise the rates of their economic growth, face the problems of unemployment and poverty, and embark on carrying out an agenda of national development for achieving coherence of their economies.

* The pessimistic scenario

In the light of a lack of political settlement and the domination of the zero solutions adopted by internal war directors and parties of foreign disputes, there will be a “pessimistic” scenario of a continued collapse with further losses in the economic fortunes of the region, including the human, natural, and financial resources.

The countries which suffer from internal conflicts will be most affected by these losses. Also, the Gulf countries and Iran will pay the due bills for the continuation of these wars, including the purchase of weapons from the West and America as well as China and Russia.

This time, the Gulf countries and Iran would bear more economic costs, even if the oil price reached $ 60 a barrel in 2017. Accordingly, the deficit of the public budgets of Gulf countries is expected to increase and the growth rates are expected to slow down.

There is current evidence confirming these expectations, where many public projects in the Gulf States were put off, and some steps in the framework of the so-called economic reform programs were taken, including cutting subsidies, the imposition of new taxes, reducing labor in the public sector and the government, as well as the expansion of the public debt.

In general, the continuation of this scenario is expected to give a negative impact on the investment climate in the region, leading to a decline in direct investment inflows, and even to the escape of the domestic capital.

This impression is also expected to be detrimental to the countries of the region, particularly Egypt, which relies heavily on attracting foreign investment. However, Egypt by virtue of its local situation, as well as the negative regional climate, would not be able to bring direct foreign investments, especially those pertaining to economic production sectors or outside the oil-scale in general.

The economy of Egypt is expected to pass through more bottlenecks during 2017, because of the external debt obligations, which have recently been estimated by the Governor of the Central Bank of Egypt at about $ 7 billion, as well as the continued crisis of the dollar gap.

With regard to the future of the Turkish economy, it mainly depends on realizing success in stopping the violence groups’ bombings, as their continuation could cause a crisis during 2017. Though the Turkish economy possesses large production capabilities that have enabled it to rely on exports, however, the loss of tourism and direct foreign investment could disrupt the performance of the balance of payments, and dedicate the continuing decline in the value of the national currency.

We can say that the biggest beneficiary of the scenario of the continuing economic and political collapse in the region is Israel, which would enable it to activate the old “Middle East” project. However, this time, the decline in many economies in the region will give Israel an opportunity to impose its terms in integration with the regional economies.

The West and the United States are no longer interested in ending the conflicts in the region, while Russia is significantly existing in the region, which can be read as part of the conflict between Russia on the one hand, and America and Europe on the other, for draining Russia economically by implicating it in the region. But this must be seen from the other side, as Russia has economic interests represented in increasing its economic dealings with Iran and in practicing greater influence on the Syrian economy.

In fact, the United States and Europe feel reassured toward the continuation of the region’s oil revenues investment in their countries. The economic interests of the West are only disturbed by illegal immigration from the countries of the region, which is really dealt with on several axes, particularly towards Turkey.

*Abdel-Hafez Al-Sawi is an Egyptian economist. He has many economic writings, including: The Post-Revolution Balance, the Employment of Zakat Funds in the Muslim World, A Development Vision, and the Egyptian Economy between the Taxes and the Zakat.

(This article was written exclusively for Middle East Observer and translated from Arabic)