Iran expressed its satisfaction about the latest deal with OPEC that included cutting the oil production to support its international prices, giving reaffirms and hope about future cooperation.

The Organization of the Petroleum Exporting Countries agreed on Nov. 30 to cut output by 1.2 million bpd to 32.5 million bpd for the first six months of 2017 after this decision was hindered for long by Iran’s refusal.

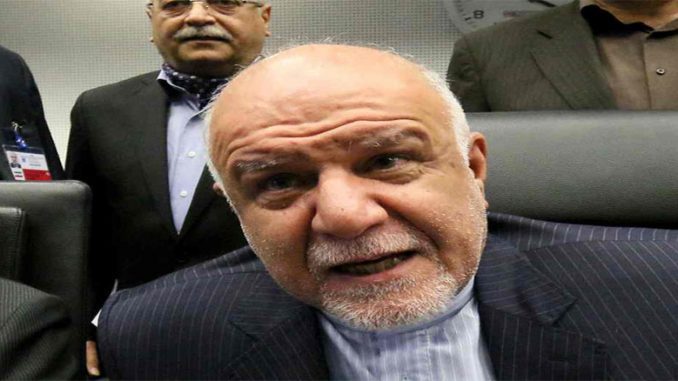

“OPEC members’ level of compliance to cut oil production in January has been acceptable and we predict more cooperation from the non-OPEC members in near future,” Bijan Zanganeh was quoted as saying by the Mehr news agency.

On February, Minister of Petroleum Bijan Zangeneh said that the export of petroleum products is an approach adopted by the Iranian Ministry of Petroleum, adding Iran is currently meeting most of its energy needs by natural gas which would allow raising export of petroleum products.

Zangeneh further announced that the Iranian Ministry of Petroleum is bent on raising export of petroleum products, adding gasoil and petrol will be the only main liquids consumed in Iran’s energy mix by next year.

Iran can currently refine 1.7 mb/d of crude oil by its refineries.

According to Zangeneh, Iran’s crude oil output is at 3.9 million barrels per day, adding the country is now pumping 3.9 million barrels of oil per day.

However, Iran said an increase in oil prices to more than $55 per barrel was not in the interest of OPEC as it would lead to a rise in output by non-OPEC producers, calling for international understanding between the different oil producers.

“If oil prices specifically surge over $55 or $60 per barrel, non-OPEC producers will increase their crude production to benefit the most from the price hike,” Iranian Oil Minister Bijan Zanganeh was quoted by Fars as saying.

“OPEC is determined to reduce its production to help manage the market.”

Iran and using oil as a winning card

Last year in Novemer, OPEC has agreed its first oil output cuts since 2008 and Iran accepted the deal and cutting its productions after months of resisting, while Saudi Arabia accepted “a big hit” on its production to be able to stabilize the market in the end.

In September, OPEC agreed in principle at a meeting in Algiers to reduce output for the first time since the 2008 financial crisis.

Iran, according to delegates from other OPEC members, was unlikely to restrain supplies, given that it believes Saudi Arabia should cut back itself to make room for Iranian oil, in a clear sign of the tension and clash for power between the regional rivals.

Before signing the deal, sources said Saudi Arabia and its Gulf allies have signaled they were prepared to cut close to 1 million bpd of their output, as Saudi Arabia alone could cut up to 500,000 bpd.

“Eighty-five percent of proposed OPEC cuts are from Gulf countries but Iran is still not in favor,” one source said.

These numbers means that Gulf countries will be cutting important income for the sake of stabilizing the market, but Iran was still refusing, wanting to increase the pressure on them in a show of power.

Saudi Arabia produced a near-record-high 10.26 million barrels per day in April and has kept output relatively steady over the past year, and refused to cut its production in order to give Iran its share and keep the market steady.

The signals that Tehran has been sending seem to be clear: the country’s top priority is reviving its energy industry after years of sanctions and its willingness to contribute to a production curb is very conditional.

However, this changed after pressure by Russia on Iran over the issue.

Putin established that the Saudis would shoulder the lion’s share of cuts, as long as Riyadh wasn’t seen to be making too large a concession to Iran.

In the end, the Saudis agreed to cut production heavily, taking “a big hit” in the words of energy minister Khalid al-Falih – while Iran was allowed to slightly boost output and proves its ability to use the oil issue as a winning card to put more pressure on its rivals in the region.