Dollar to Turkish lira rate slips in line with US dollar weakness in almost all major currencies and emerging markets. However, investors just want Turkey’s 16 April referendum done with and think of how markets are most likely to react to possible outcomes.

The U.S. dollar versus Turkish lira rate dipped below 3.59 in early trading Monday as the Trump administration’s failure to pass a new healthcare bill pushed the U.S. dollar lower in global markets.

The dollar to Turkish lira rate slipped as low as 3.5855 on Monday at 0715 GMT, down 0.50 percent compared to the previous close on Friday, in line with broad U.S. dollar weakness seen in almost all major currencies and emerging markets.

The tone in U.S. dollar sentiment profoundly changed after the Trump administration came up short of votes in Congress last Friday to repeal Obamacare, one of Trump’s key oft-repeated campaign promises.

As the setback suggested Trump may be unable to keep his campaign promises, which have buoyed U.S. and global markets, investors needed to reassess their portfolios.

The U.S. dollar index, which track the greenback’s value against a basket of major currencies, slipped below its 150-day moving average to 99.05 points on Monday, its lowest reading since last November’s American presidential election.

How markets are most likely to react to the referendum’s possible outcomes

Bloomberg stated in its report how markets are most likely to react to the possible outcomes of the expected referendum according to interviews with investors:

SCENARIO ONE: Yes wins

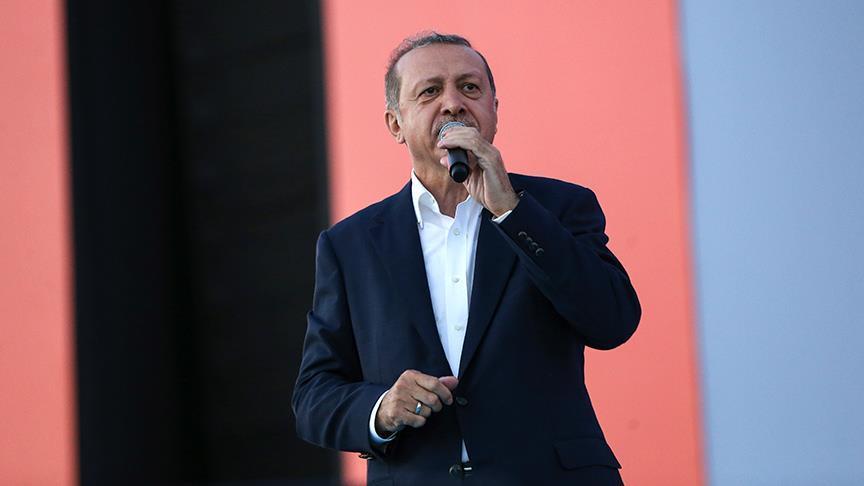

Verdict: May see a relief rally in Turkish assets as status quo maintained and Erdogan’s role formalized. Investor focus will return to economic fundamentals while attention on the political front shifts to new elections.

This outcome is broadly seen as maintaining the current power compass, where Erdogan’s place as the supreme political authority is not in doubt. While many fund managers say it may lead to an initial relief rally, many also question whether it’ll last.

“A ‘yes’ vote will bring temporary relief, but immediately will pose a question of when Erdogan will go for new elections,” says Anastasia Levashova, a fund manager at Blackfriars Asset Management Ltd. in London. “Some experts say that it can happen as early as summer 2017, so this will not give much stability to the market.”

Investor perception will probably even deteriorate in the medium term, many say.

“Turkey’s governance system will look a lot like Russia” if the constitutional amendments pass, says Haydar Acun, a fund manager at Istanbul-based Marmara Capital. “You have to be ready for a re-rating in light of the new risks.” For comparison, Turkey’s benchmark gauge of stocks is trading at 8.6 times expected earnings over the next 12 months, compared with a multiple of 6 times for Russia’s Micex Index.

Still, “the best scenario will be a ‘yes’ because de facto the current system is a presidential system” supported by the ruling AK Party, or AKP, says Guillaume Tresca, a senior emerging-markets strategist at Credit Agricole SA in Paris. “Erdogan already has all the powers and so for the markets, and especially foreigners, it would mean ‘no change.’”

“In case of a “yes” vote, I think Turkish investors will breathe a sigh of relief,” says Per Hammarlund, chief emerging-markets strategist at SEB SA in Stockholm. “Erdogan and the AKP will have achieved a key objective and markets will speculate on when the next general election will take place, not a significant source of volatility.” He predicts the yield on 10-year lira bonds could fall by about 80 basis points to around 10 percent. “Foreign investors will fret over the potential of Erdogan becoming more involved in economic policy making, but they will stay put, lured by high carry.”

SCENARIO TWO: No wins

Verdict: Market negative. Erdogan probably won’t leave it here, meaning the likelihood of markedly increased political tensions and early elections increases.

Most money managers see a “no” vote as more destabilizing for markets. That’s despite assurances from the leader of Turkey’s main opposition party, the Republican People’s Party or CHP, that such an outcome would simply mean the continuation of the current system, and that it wouldn’t lead to debate on Erdogan’s legitimacy. If Erdogan was insistent on ramming the changes through though, his next move could be to call snap elections in an effort to deprive the nationalist MHP or pro-Kurdish HDP of seats in parliament, which would let the ruling party pass the constitutional amendments alone.

“The downside risks over 6-12 months are large in the case of a ‘no’ vote,” says Hammarlund. “Markets will start to sell off on concerns about what is to come. I expect Erdogan and the AKP to push Turkey towards new elections in the hope of pushing out either the HDP or the MHP, or preferably both.”

Tresca, from Credit Agricole, echoes that view. “Erdogan will not give up,” he says. “He will find a way to bypass the result. And so it could bring uncertainties, and markets hate uncertainties.”

A ‘no’ vote “would be followed by increased pressure and augmented efforts by Erdogan and his supporters to formally anchor the presidential system,” says Wolf-Fabian Hungerland, an economist at Berenberg Bank in Hamburg. “This probably involves increased tension within society, let it be with respect to the Kurds, Europe, the press or generally any ‘opposition.’ Erdogan is bound to legitimate his de facto power also de jure – no matter what. This, in turn, means that markets will face yet another load of uncertainty. This would mirror in asset prices.”