A UAE wealth fund buys stakes in Egyptian fertilizer and cargo companies as part of a $2-billion investment in the country, according to Bloomberg.

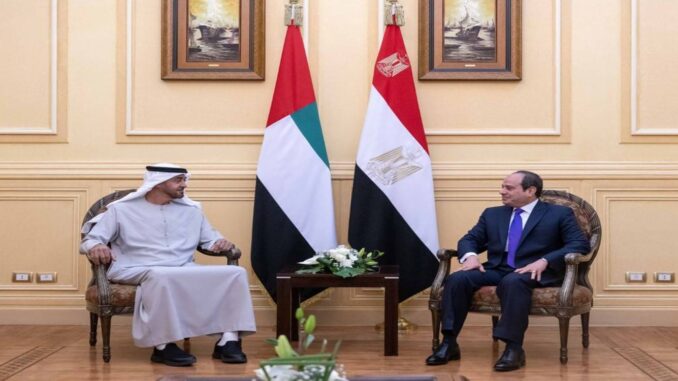

An Abu Dhabi wealth fund has agreed to invest about $2 billion in Egypt by buying state-held stakes in some companies, including the country’s leading private-sector bank, Commercial International Bank (CIB) and fertilizer companies.

According to Bloomberg, the Abu Dhabi Developmental Holding Company (ADQ), a sovereign wealth fund, is also “acquiring Egypt state-held stakes in Abou Kir Fertilizers & Chemical Industries, Misr Fertilizers Production Co. and Alexandria Container & Cargo Handling Co., according to the person, who asked not to be identified as the agreement is confidential”.

According to a report by Bloomberg, citing people familiar with the deal, Abu Dhabi’s ADQ, which has previously invested in the North African country, will acquire about 18 per cent of CIB which accounts for about half of the overall deal.

The unnamed sources also revealed that ADQ is buying stakes in four other companies listed on Egypt’s stock exchange, including the Fawry for Banking & Payment Technology Services and Commercial International Bank Egypt SAE, Cairo’s largest listed lender..

The UAE and, in particular ADQ, are long-term investors in Egypt, with the sovereign wealth fund having acquired an Egyptian pharmaceuticals company from Bausch Health Cos last year for $740 million. Later that year, as part of a consortium, ADQ purchased Egyptian real estate developer, SODIC, for $388 million.

News of the agreement comes as Egypt comes to grips with the impact of Russia’s invasion of Ukraine last month, with the conflict posing an existential threat to Egypt’s food security. Egypt is the world’s largest wheat importer, most of which comes from both Russia and Ukraine.

A few days ago, Prime Minister Moustafa Madbouly, set the price of commercially sold bread at 11.50 Egyptian pounds ($0.66) per kg, according to a statement by his office.

The Ukraine war has also caused the Egyptian pound to depreciate by almost 14 per cent, with foreign investors withdrawing billions of dollars from Egyptian treasury markets.

The Central Bank also announced that it had raised interest rates, which has been met with growing popular outrage.

Urgent need for foreign exchange

In a move that reveals the urgent need for foreign currency in Egypt, Abu Dhabi’s sovereign wealth fund has agreed to invest about $2 billion in Egypt by buying stakes in state-owned assets in some companies, including the largest private bank listed on the Egyptian Stock Exchange, according to informed sources quoted by Bloomberg.

The move, in addition to the devaluation of the Egyptian pound two days ago, comes as one of the mechanisms for providing foreign currency, as Egypt is suffering from a severe shortage as a result of the withdrawal of indirect foreign investments due to the global economic crisis caused by the Russian-Ukrainian war.

According to the sources, the deal includes the purchase of state-owned shares in some companies and banks, including 18 per cent of the Commercial International Bank, as well as government shares in four companies listed on the stock exchange, including Fawry Banking and Payment Technology Services.

Enterprise quoted government sources saying that the Egyptian government is not expected to resort to obtaining new deposits from the GCC countries but indicated that there is a desire among policy makers to extend Gulf deposits in the Central Bank of Egypt, which are believed to amount to about $15 billion.

Instead, policymakers will speed up the process of offering attractive state assets for sale to Gulf buyers by bringing new assets to the market and selling additional stakes in listed companies controlled by the government.

It appears that the decision to depreciate the pound against foreign currencies is not sufficient to guarantee cash flows and compensate for the shortage in foreign assets at local banks, as they fell to negative levels.

This put pressure on the value of the local currency, as net foreign assets amounted to negative $7.1 billion at the end of November, according to the data of the Central Bank of Egypt.

As international financial institutions warned, credit rating agency Fitch warned that the conflict in Ukraine would lead to reduced tourism inflows, higher food prices and greater financing challenges.