While the Egyptian government is actively seeking a new loan from the International Monetary Fund (IMF), the country still owes the Fund over $17 billion, due within five years.

Egypt had borrowed $20 billion from the IMF through three agreements during the past six years—$12 billion in November 2016 through the Extended Fund Facility (EFF), $2.8 billion on May 11, 2020, through Rapid Financing Instrument (RFI) and $5.2 billion on June 26, 2020, through a Stand-By Agreement (SBA), states Hagar Omran, senior reporter at Forbes Middle East, in a recent report on Forbes

The schedule

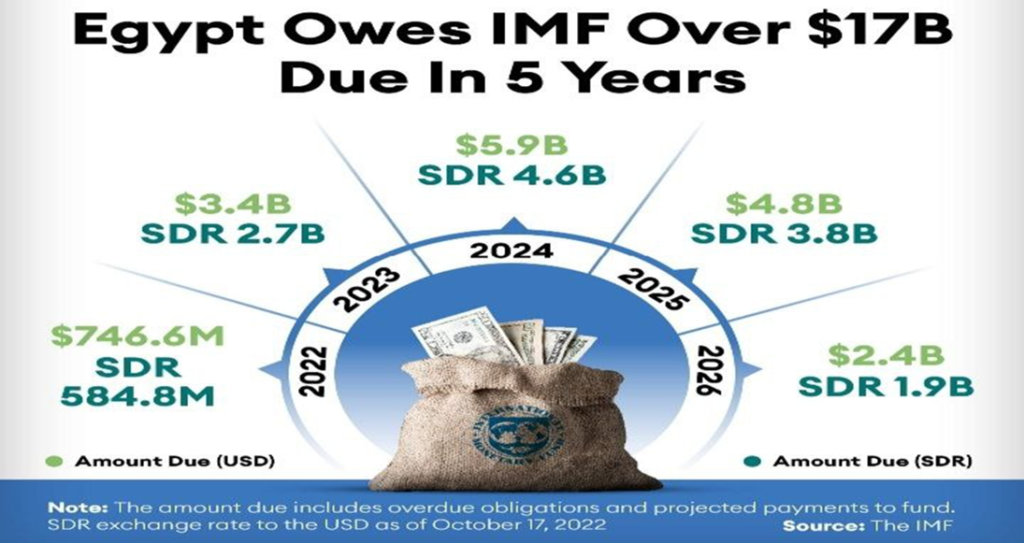

In the next two months of 2022, the IMF projects Egypt to repay 584.8 million of special drawing rights (SDR) or $746.6 million out of the total SDR 13.6 billion ($17 billion) due till 2026.

The amount due in 2023 includes about 19.5% of the amounts due through 2026, or SDR 2.7 billion ($3.4 billion). Egypt will have to repay 33.7% of the current dues during 2024, representing SDR 4.6 billion ($5.9 billion).

IMF’s future receivables from Egypt include SDR 3.8 billion ($4.8 billion), expected to be repaid in 2025. Cairo is expected to repay SDR 1.9 billion ($2.4 billion) in 2026. Notably, we calculated the 1 SDR exchange rate at USD 1.276 as of October 17, 2022.

If Egypt and the IMF agree on new funding, it will be the 12th since the Fund’s inception. Egypt has agreed on 11 financing agreements with the IMF totaling SDR 16.36 billion (equivalent to $20.9 billion). Yet, Egypt hasn’t drawn the financing agreed upon in 1993 and 1996, amounting to SDR 400 million and SDR 271.4 million, respectively.

The SDR is an international reserve asset created by the IMF to supplement the official reserves of its member countries. A basket of currencies—the US dollar, Euro, Chinese Yuan, Japanese Yen, and the British Pound — defines the SDR.

Awaited agreement

After Egypt’s negotiations with the IMF have faltered during the past few months, the IMF and the WBG’s annual meetings held from 10-16 October, came as a glimmer of hope for the long-awaited agreement.

This comes when the Egyptian economy suffers from the consequences of the Russian-Ukrainian crisis. The Egyptian officials and the IMF representatives have talked about a staff-level agreement without announcing the details of the deal.

On October 15, the IMF revealed a staff-level agreement with Tunisia worth $1.9 billion through a 48-month EFF program. This shows that only official reassurances were for Egypt, while the real financing was for Tunisia.

The aspects of the crisis that the Egyptian economy is currently experiencing include all sectors that depend on the hard currency, from automotive to fodder, whose crisis has intensified during the past days and sparked controversy, with traders filming videos of executing young chicks. They claimed the inability to feed them.

Collecting USDs

Egypt has made several decisions recently to increase its US dollar (USD) collection, including the cabinet’s approval to a draft law that stipulates the right of Egyptians expats who have valid residency abroad to import one private passenger car for personal use, exempt from taxes and fees.

Egypt expects to attract foreign currency worth about EGP 50 billion ($2.5 billion) from the four-month initiative it announced recently. The government also announced settlements of a number of disputes with investors to attract foreign direct investment and improve the investment climate.

Egypt is organizing a three-day economic conference from October 23 to discuss investors’ problems and offer solutions to them.

Primary concerns

The annual inflation rate for all Egyptian governorates rose 15.3% in September, compared to 8% for the same month of 2021. For its part, the Central Bank of Egypt (CBE) maintained key interest rates at 11.25% for deposits, 12.25% for lending, and 11.75% for main operations, during its meeting on September 22. It also increased the mandatory reserve from 14% to 18% to withdraw excess liquidity and curb inflation.

The CBE has raised the interest rates by 300 basis points this year, 100 basis points in an extraordinary meeting on March 21, and then raised it by 200 basis points on May 19.

The EGP declined against the USD by 20% year-to-date, bringing the USD exchange rate to EGP 19.71, according to the CBE on October 17, from EGP 15.78 at the end of December 2021.

Egypt’s net foreign reserves declined by 18.8% to $33.2 billion at the end of September, compared to $40.9 billion at the end of December 2021, despite the deals the country made with Saudi Arabia, the UAE and Qatar to support foreign resources, whether in the form of deposits with CBE or stock exchange investments.

Egypt’s external debt rose to $157.8 billion at the end of March 2022 from $134.8 billion at the end of the same month in 2021.

Hany Genena, an economic expert in Egypt and adjunct lecturer at the American University in Cairo, told Forbes Middle East in July that the Egyptian currency is under pressure for the short term, expecting it to reach 20 against the dollar during 2022.

Genena expected the current negotiations with the IMF to include reducing subsidies, especially for diesel, bread, and fertilizers. “Historically, the Fund’s negotiations include adopting a flexible exchange rate, but the most important thing now may be the subsidy file,” he added.