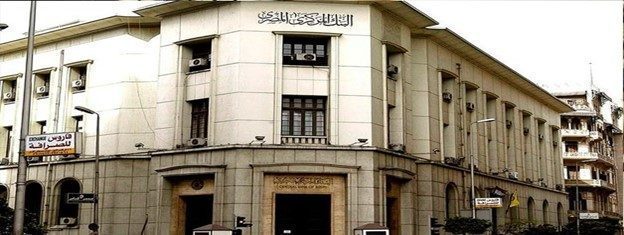

Hadn’t it been for the surprise decision by Egypt’s central bank to keep the ‘overnight interest rates’ unchanged, the emerging-market investors would have excitedly returned to Egypt, due to recent devaluation of the pound.

Egypt’s central bank a week ago kept its overnight interest rates unchanged, under the pretext that the steep rate increases put in place over the last year should help to tame inflation, now running at 21.3%.

The CBE hold had been unexpected by many analysts, according to a poll of 13 analysts forecast the bank would raise rates by a median 150 basis points, according to Reuters.

“Emerging-market investors were getting excited about a return to Egypt after last month’s devaluation of the pound. A surprise from the central bank is keeping them away,” said Netty Ismail, a Bloomberg journalist, in a recent report.

“Policymakers last week defied most analysts’ expectations by leaving borrowing costs unchanged for the first time since September,” she said.

That disappointed many would-be investors who were looking for higher interest rates, according to Edwin Gutierrez, head of emerging-market sovereign debt at abrdn in London.

“We think it’s a policy mistake and definitely caused some investors to rethink,” Gutierrez said.

Attracting foreign investors back into local debt is becoming critical for Egypt, which has been locked out of global capital markets for about a year. On Tuesday, Moody’s Investors Service downgraded Egypt’s credit rating one notch deeper into junk territory to B3, on par with Angola and Turkey.

Even with the nation’s new International Monetary Fund program, Moody’s analysts warned it will “ultimately take time to tangibly reduce” Egypt’s vulnerability to external risks — such as higher borrowing costs and inflationary pressures.

Egyptian Yields Fall Below Zero When Adjusted for Inflation. Negative real yields on 12-month Treasury bills deter investors:

Source: Bloomberg

Just last month, many investors were talking about buying again, citing a cheaper pound and record yields when compared with peers.

Since then, rising prices have left Egyptian yields below the soaring inflation rate, sapping the appeal of investing in bonds. Meanwhile, the pound this year has shed another 18% of its value against the dollar.

Amid lackluster demand, yields on nine- and 12-month Egyptian Treasury bills climbed to record highs at the latest auctions. The higher yields are increasing the nation’s debt-servicing costs at a time when the US Federal Reserve’s resolve to continue hiking has hit demand for riskier assets.

With investor concerns mounting, the government of one of the Middle East’s most indebted nations opted to issue dollar-denominated Treasury bills on Monday. It sold $1 billion of 12-month securities at a yield of 4.9%, attracting 1.3 times the amount on offer.

Egypt’s central bank has said it’s assessing the impact of last year’s combined 800 basis points of rate increases on the economy, but the pause in the hiking cycle is unlikely to last. Headline inflation will probably accelerate to above 25% in February, forcing another 300 basis points of increases in the first half of the year, according to Abu Dhabi Commercial Bank.

“The dovish surprise can’t help but lead to some second-guessing of the bank’s commitment to inflation and is just one more reason to wait for further clarity before jumping back into the local market,” said Gordon Bowers, a London-based analyst at Columbia Threadneedle Investments.

Moody’s said the Egyptian government’s “dedicated domestic funding base” is among factors mitigating liquidity risks, with a more flexible pound helping the country’s competitiveness and reducing demand for foreign exchange.

But it also warned that higher volatility in the currency can feed into more inflationary pressure, “resulting in higher than currently assumed interest rates and borrowing costs.”

The nation’s dollar bonds fell for a fourth day, with the yield on the security due 2032 rising two basis points to 12.1% as of 10.30 a.m. in London.

Further monetary tightening and encouragement of foreign inflows would be needed for the pound to hit a trough against the dollar, according to Goldman Sachs Group Inc.

The central bank’s pause “may have interrupted the recent momentum of policy decisions, which have been tentatively recreating the conditions for an attractive carry trade in the pound,” Goldman Sachs strategists including Kamakshya Trivedi said in a report.

Moody’s downgrades Egypt’s rating

Ratings agency Moody’s on 7 February lowered Egypt’s sovereign rating by one notch to B3 from B2, citing the country’s reduced external buffers and shock absorption capacity.

Moody’s Investors Service downgraded Egypt’s credit rating to B3 from B2 owing to the country’s reduced external buffers and shock absorption capacity as it pursues economic reforms and structural changes in line with its International Monetary Fund program.

Egypt has continued to face a foreign currency shortage despite allowing the Egyptian pound to depreciate sharply in recent months.

“Liquid foreign exchange (FX) reserves have declined since the negative outlook assignment in May 2022 and FX liquidity buffers in the monetary system have dwindled (as measured by the build-up of large net foreign liability positions at the central bank and commercial banks), increasing external vulnerability at a time of fragile global conditions,” the rating agency said.

The country’s headline inflation is expected to accelerate further in January after surging to its highest in five years in December, according to a Reuters poll.

Last year, Egypt agreed to a $3 billion rescue plan with the IMF that is contingent on the country introducing a flexible foreign exchange regime and reducing the state’s footprint in the economy to allow more room for the private sector.

Moody’s said the Egyptian government state-owned asset sale strategy that kicks off this month as part of the country’s new IMF program will support its structural adjustment and help generate sustained non-debt creating capital inflows to meet increased external debt service payments over the next two years.

Egypt’s liquid foreign currency reserves have declined to $26.7 billion at the end of December 2022 from $29.3 billion at the end of April 2022, while the net foreign liability position in the monetary system has increased to $20 billion at the end of December from $13 billion in April, according to Moody’s.