Amid an acute economic crisis, the Egyptian population has been crushed between the low income and the rising household expenses, where inflation has inflicted additional pain on ordinary people.

“The increasing costs of living helped trigger the Arab Spring uprisings a little over a decade ago, and the Egyptian authorities are quite mindful of such risks,” states Mirette Magdy, in a recent piece on Bloomberg.

“Egypt is in the throes of a familiar crisis; the currency has plunged, foreign-exchange is in short supply and living costs have soared. It’s a once-a-decade experience that’s made the country the International Monetary Fund’s second-biggest borrower after Argentina,” says Magdy, continuing:

Policymakers say this time is different, and a swathe of promised reforms stand to give a makeover to Egypt’s markets, economy and perhaps society as a whole. But that hasn’t made it much easier to predict when the current crunch may end.

Here are five areas to watch that may show where things are heading next.

The Egyptian pound

In compliance with a longstanding IMF demand that helped secure a $3 billion deal, the Egyptian currency is more flexible. But long stretches of stability have followed bursts of volatility and steep downswings.

Ending that uncertainty, and showing the practice of using international reserves and banks’ foreign assets to protect the pound has been truly cast aside, may be key to almost everything else. Investors won’t pour more money into bonds or company stakes if they can’t rule out another plunge in the currency.

Some more modest dips and climbs for the pound in the weeks ahead would be a sign it’s more accurately reflecting supply and demand. The steady resumption of some imports after the clearing of a backlog at Egypt’s ports would also show foreign-exchange flows are improving and pressure on the pound easing. But while the steepest falls may be over, analysts including at Standard Chartered Plc and HSBC Holdings Plc aren’t ruling out more weakening this year.

Debt

The days when foreign investors held over $30 billion in Egyptian local debt may be long gone, but a modest revival in overseas interest before July will signal the country is on track to cover its immediate funding gap.

Authorities are targeting $2 billion in net inflows by then, a goal that likely depends on investors’ confidence the pound isn’t being closely managed and yields on local securities are not negative when adjusted to inflation. Appetite remains weak, going by a gauge of demand for Egypt’s 12-month securities.

A much larger reliance on bond sales will ring alarm bells, indicating Egypt is rowing back on plans to wean itself off hot money and returning to an approach that helped spur the current crisis.

Gulf Aid

Expectations that Egypt’s Gulf allies would fully open the taps have been misplaced. Almost a year since more than $10 billion of investment was pledged, only a fraction of this funding the IMF has called critical has materialized. Saudi Arabia’s recent comments about seeking reforms before it supports other nations sparked speculation over the holdup.

All this means the next large-scale deal — mostly likely involving the sale of an Egyptian state-held stake of a major company to the United Arab Emirates, Qatar or Saudi — may be a watershed moment, swiftly followed by more transactions. It may signal Gulf investors see the pound as having bottomed out, finally allowing them to settle on what they see as fair local prices for assets.

State/Army Exit

Deep in the IMF’s latest report were lines that may be key to Egypt’s future: a promise that overarching state involvement in the economy, including by the army, will be curbed. It tackles head-on a long-standing complaint that the private sector has been crowded out, discouraging badly needed foreign investment.

No one’s pretending it’ll be easy. The IMF, which also won a pledge that state entities will regularly open their accounts to the Finance Ministry, has warned any re-balance “may face resistance from vested interests.” Egypt has named 32 state-owned assets in which it’s selling stakes, and swift movement on the offerings would be taken as a positive step. Also key will be the long-mooted first-ever sale of an Egyptian army-linked firm — that of Wataniya, a fuel distributor running a vast national network of gas stations.

Inflation

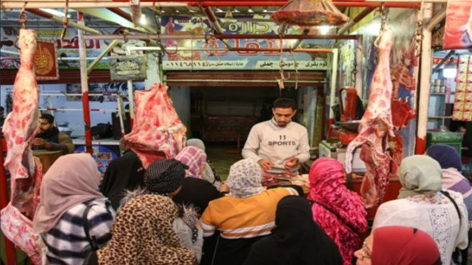

Galloping inflation that’s showing no sign of easing is heaping misery on Egypt’s more than 100 million people, working and middle classes alike. Food prices soared in January at the fastest pace on record, and the government says tackling the surge is a top priority. Families are cutting back and Ramadan-period state discounts have been introduced early. The state nutrition watchdog’s suggestion that Egyptians eat more chicken feet spurred anger.

Authorities are mindful of the risks; increasing costs of living helped trigger the Arab Spring uprisings a little over a decade ago. When inflation begins to slow — possibly in the second half of 2023 at the earliest – that might give some modest comfort.