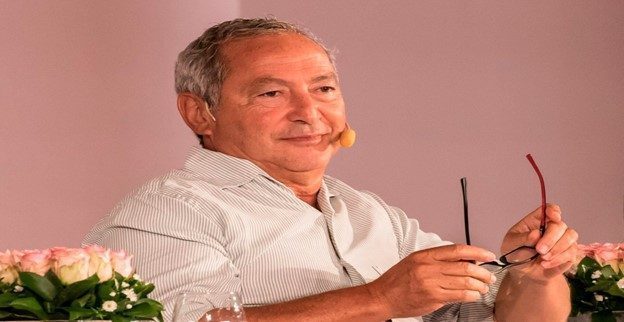

Egyptian business tycoon Samih Sawiris says Saudi Arabia a more promising place to invest, as his country now has three different exchange rates

Egyptian billionaire Samih Sawiris has declared that he is not going to invest in any new projects in Egypt at the moment, due to uncertainty over the country’s exchange rate.

In an interview with the Dubai-based Al-Arabiya Business channel Tuesday, Sawiris said the Egyptian pound currently has three exchange rates, which complicated the ability of investors to conduct feasibility studies. Therefore, he will not be launching new investments in Egypt until the currency and economy stabilize.

The Egyptian pound plunged 40 per cent against the dollar in 2022 – one of the worst performances of an emerging market currency last year – and started 2023 by falling more than seven per cent. While inflation in the North African state has also been rising steadily.

Asked whether he had stopped investing in Egypt at the moment, Sawiris said:

“Yes, of course. How do I know if the project will make a profit or a loss? I have to be aware of everything. Should I calculate based on the international price, which is 42, or the black market price in Egypt, which is 36, or the official price, which is 31? This is in itself a killer for any expectation of profitability or feasibility. Therefore, everyone is waiting.”

Sawiris criticised the government’s fiscal and economic policies that failed to liberalise the exchange rate, which he said had a “suffocating” impact on the private sector. Foreign currency shortage, he said, had prevented the entry of materials to the country.

According to some local media, Sawiris has expressed interest in investing in Saudi Arabia, either personally or through his Orascom Development Holding. He previously highlighted that the real estate market in Egypt is currently experiencing a correction phase, pointing out that some companies will withdraw from the market due to their failure to fulfil promises made to customers.

Sawiris added that serious companies operating in the Egyptian real estate market have been significantly affected by rising inflation, but they will continue their work despite the challenges. He continued: “No company has clarified in its accounts the extent of the high inflation in Egypt and the world, which has caused an increase in prices.”

“The volume of the private sector in the overall economy has dropped from 62 percent to 21 percent in the past 10 years,” he said, citing Egypt’s official statistical agency, Capmas.

“I was shocked by this deterioration (in the private sector), because it is one of the significant impacts of the strangling of the Egyptian currency,” he added.

He cited the example of the Turkish floating exchange rate regime, saying it has not had a significant impact on the movement of imports and exports despite the decline of the exchange rate.

Egypt “should have left the market to rule,” he said, “because if you try to strangle the market, you may kill it”.

In contrast to his pessimism about Egypt, Sawiris said he was optimistic about Saudi Arabia.

“This is the number one promising area in the Arab world,” he said, revealing that he is considering a number of investment projects in the Gulf kingdom, which he refused to disclose.

Sawiris and his family are among the richest people in Egypt, and all of Africa. He is the youngest son of Egyptian construction tycoon Onsi Sawiris and the current leader of Orascom Development. The company specializes in constructing and managing resorts located in Egypt, Montenegro and Switzerland.